FHSA: The Ultimate Guide to Tax-Free Saving for First-Time Homebuyers in Canada

Are you dreaming of owning your first home but struggling to save for a down payment? You're not alone! Luckily, the Canadian government has introduced a new program to help prospective first-time homebuyers in Canada save for their first home tax-free: the First Home Savings Account (FHSA).

The FHSA is a savings account that allows individuals to contribute up to $40,000 on a tax-free basis. That means any investment income earned within the account, including interest, dividends, and capital gains, is not subject to tax! Plus, withdrawals from the account can be made tax-free to buy a first home under certain conditions.

To open an FHSA, you must be a Canadian resident over the age of 18 and a prospective first-time homebuyer. That means you haven't owned a home or lived in a home owned by your spouse or common-law partner in the past four years. So, if you're a first-time homebuyer looking to save for a down payment, the FHSA is a great option for you!

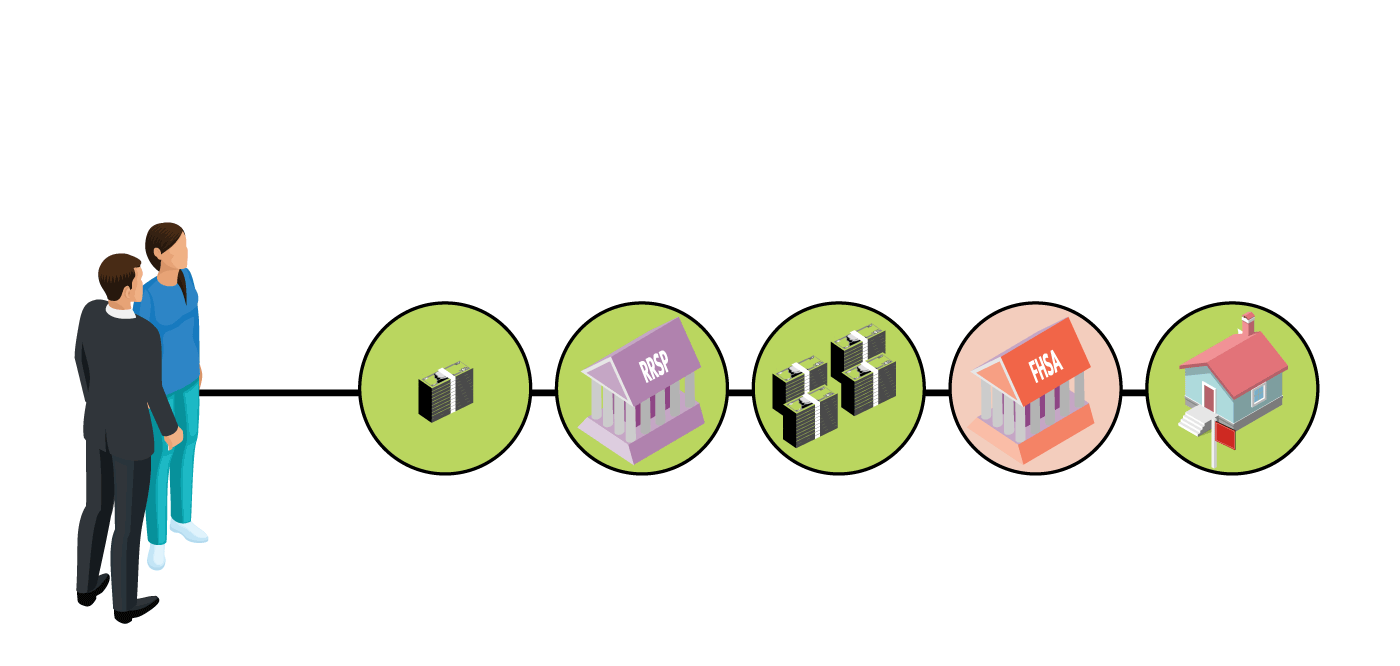

One of the best things about the FHSA is that it can be used in combination with other government programs, such as the Home Buyers' Plan (HBP). The HBP allows first-time homebuyers to withdraw up to $35,000 from their RRSPs to use towards a down payment on a home. By contributing to both an FHSA and an RRSP, you can save for a down payment while also taking advantage of tax benefits and government incentives.

But wait, there's more! The FHSA is not just a savings account, it's an investment account. That means you can choose from a variety of investment options to grow your savings even faster. Plus, the FHSA is flexible, so you can adjust your contributions and investment options as your financial situation changes.

In conclusion, the FHSA is a valuable program for prospective first-time homebuyers in Canada looking to save for a down payment on a home. With its tax-free investment income, flexible withdrawal options, and potential for investment growth, the FHSA is a great way to reach your homeownership goals while also taking advantage of government incentives. The government expects that Canadians will be able to open and contribute to an FHSA at some point in 2023. No matter when this happens in 2023, Canadians would be allowed to contribute the full $8,000 annual limit in that year. So, start saving for your dream home today with the FHSA!